Compliance isn't a barrier, it's an enabler

Proper due diligence in a business transaction is something you do every time you consider a new customer, whether they're the other side of the world or the other side of the corridor. Sure, there's more to consider, and more potential pitfalls to catch you out, when you're trading across borders, but it's essentially the same process; your paramount consideration is making sure you'll get paid, and not be kept waiting. And if you're the customer, you need assurance that your order will arrive and be fit for purpose.

The hoops through which you're required to jump to begin working with a new customer can easily blind us to this core fact. Instead of thinking of our own outcome, we get bogged down in the requirement to comply with anti-money-laundering and anti-terrorism-funding protections. They're vital, of course, but let's put those considerations aside for a moment and think only of your own business.

A bad customer is no use to you. Bad debts, costly and time-consuming litigation, generally a whole load of hassle just get in the way. And the trouble with basic "passport and utility bill" compliance is that, frankly, it doesn't do much to protect you from either.

So read on and see how our KYC systems don't just keep you compliant, they actively help your business.

How next-gen compliance can be a deal-maker

Don't just comply, lead.

Think of cutting-edge compliance as part of your competitive advantage. Every business that uses our foreign exchange services goes through detailed verification. We'll explain just how verified in a moment. And, once they're approved, their account will continue to be monitored to ensure nothing drifts out of the safe zone. It's a highly drilled-down picture that we develop, but all that detail is assembled without creating an onerous information burden on you, your customers, or your suppliers. And it's exceptionally fast - if all the required information has been supplied, we can usually approve an account within 24 hours. Compare that to the weeks or months taken by most banks.

What does that mean to your business?

Once on-boarded with Choice Forex (and, as we've already said, that's a quick and easy process), you're effectively pre-approved for similar transactions in the future. All that needs to happen is a few checks to ensure everything's still in order - and, of course, proper diligence on the new parties in the transaction. As a Choice-approved client you can apply for registration to carry the Good Choice accreditation on your website and company documents. Imagine being able to reassure your customer that your business has already been comprehensively checked and verified for international trade. It's a badge that boosts your credibility as a trustworthy, professional company.

Choice Forex next-gen compliance doesn't just ease and protect your next deal, it makes you more competitive for every deal in the future.

Purpose-Built KYC

Our compliance system is based on processes originally designed by Choice International, our parent company. They're under constant refinement and evolution by Clarency, also a Choice Group company. It's a seamless melding of in-house technologies with best-of-breed services from industry leaders.

Our own implementation of the system is optimised for multi-currency B2B payments, and can embody sector-specific services to suit a customer's particular marketplace.

Rapid Document Verification

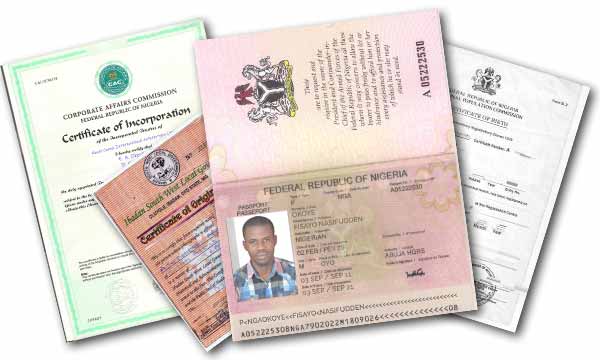

Buyer, seller and other associated parties will be invited to upload statutory documents, such as passports or certificates of authorisation. These are immediately checked, and our powerful fraud detection algorithms will spot anything from an expired document to duplicate identities or counterfeit papers. Within a couple of minutes, our system knows if everyone involved is who they say they are.

Strong machine-learning and artificial intelligence capabilities allow the system to automatically detect associated parties like co-directors, each of whom will then be invited to upload their information.

Automated background checks

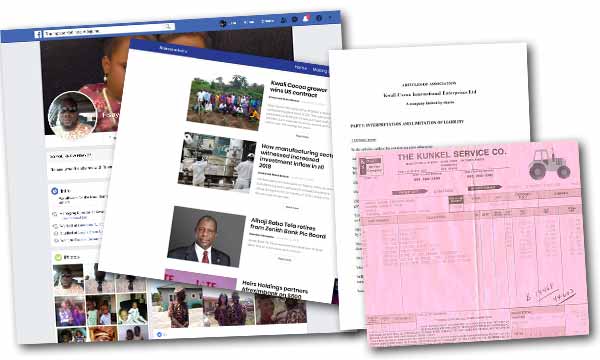

The documents and information uploaded by the applicant are just a starting point. Having recognised and recorded all the data, our system then uses it as a basis for a deep search for further background. It finds social media appearances, media mentions, even invoices and shipping documents created by the companies involved. This gives us an unmatched level of detail to verify the real background of companies associated with the transaction.

The system even understands how much items should cost, allowing it to spot questionable invoice values that could indicate money-laundering.

Ongoing Vigilance

In most cases, due diligence is a case of "when you're in, you're in", with relatively few ongoing checks to ensure that an account that started compliant stays compliant. So your customer or supplier could perform correctly on your first transaction, and then you could find yourself handling drug money on future deals. We don't do it that way. Our system checks, and then never stops checking.

This is one reason why carrying our approval really means something. It's an assurance to your customers and suppliers that your company is a safe, accredited business partner.

Do I want this level of scrutiny?

If your business isn't an honest, legal and professionally run concern, then to be frank, no you probably don't. And, to be equally frank, we'd rather you looked elsewhere for your forex. But if, like most companies, it's just looking to carry on its business successfully and profitably, then there's no easier way to give yourself a worldwide competitive edge.